Employee benefits are important for attracting and retaining talent, fostering employee satisfaction, and ensuring financial security. The Department of Labor and Employment oversees the laws in the Philippines and iterated specific benefits that employees are entitled to depending on the type of employment.

In today’s digital era, employees have high expectations for their benefits, and employers can meet these expectations by leveraging technology. The software for employee benefits should be easy to use, accessible, dynamic, and personalized. It should allow 24/7 access to benefits enrollment, document submissions, and wellness programs.

Another good use of technology for employee benefits is Cybersecurity. It is essential to protect against cyber risks and ensure data privacy. HR messaging can use multimedia to communicate essential topics engagingly and effectively.

What are Statutory Benefits?

Statutory or mandatory benefits represent the set of provisions that the law requires employers to offer their employees. Such benefits typically encompass paid annual vacation, parental leave, worker’s compensation insurance, and paid sick days.

It’s important to note that the required benefits dictated by the Philippine government set the baseline, and employers can exceed these mandated minimums by providing additional benefits.

Compliance with Labor Law

Compliance with labor laws bolsters a company’s reputation and prevents business disruptions from labor disputes.

Adhering to these laws promotes workplace equality, contributes to business sustainability, and fosters a positive work environment. According to Philippine News Agency, DOLE reported that as of November 2022, 90% of firms comply with general labor standards.

However, labor law violations have yet to end; DOLE reported 20 companies found or suspected to be engaged in labor-only contracting. The report states that over 224,000 employees are affected by illegal contracting.

Clearly, technology is a powerful tool in facilitating labor compliance by employing numerous strategies. Here are some exemplary ways illustrating how technology accomplishes this.

- Automating data collection and analysis to monitor labor practices.

- Streamlining reporting for quicker preparation of compliance documents.

- Using digital timekeeping and scheduling systems to manage worker hours.

- Offering e-learning platforms for training employees on labor laws.

- Facilitating document management to keep track of essential compliance documentation.

- Operating digital payroll systems to ensure correct and timely payment.

- Utilizing AI and machine learning for predicting potential compliance issues.

- Providing digital communication tools for addressing labor issues effectively.

By integrating these technologies into their operations, businesses can ensure they follow the law’s letter and create a more positive and equitable work environment.

Statutory Benefits As Provided In The Labor Code

Following the Philippine Labor Code, employers hiring Filipino workers must provide statutory minimum benefits or risk substantial penalties. However, they may choose to offer benefits exceeding these government-mandated minimums.

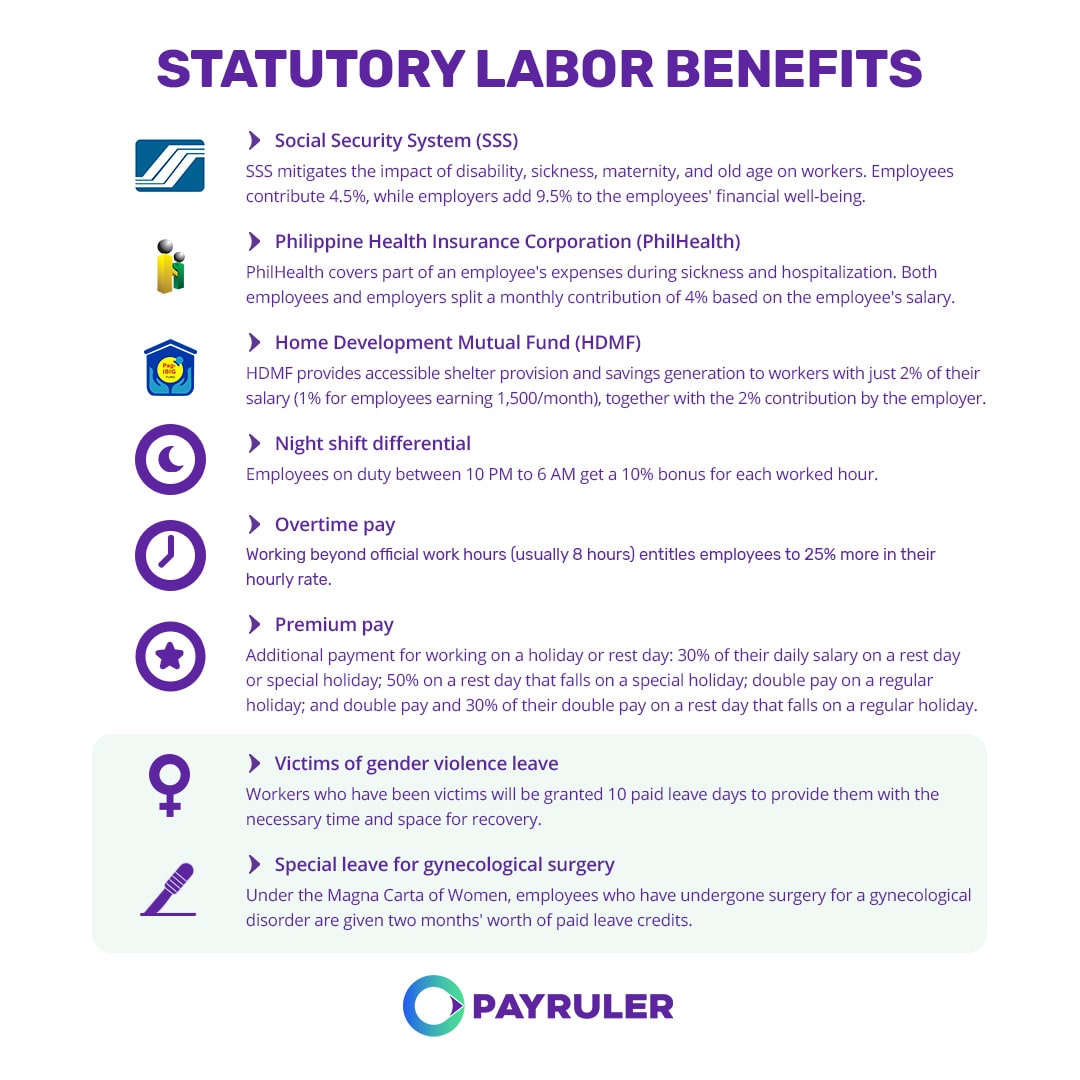

Social Security System (SSS) — covers private-sector, self-employed, and household workers. The employee and employer contribute based on the salary bracket, each responsible for percentage contributions of 4.5% and 9.5%, respectively.

Health insurance (PhilHealth) – employees and employers split a monthly contribution of 4% based on the employee’s salary, from PHP 10,000 minimum to PHP 70,000 maximum.

Home Development Mutual Fund (HDMF) – workers earning below PHP 1,500/month contribute 1%, while those making more contribute 2%. Employers contribute 2%. The total contribution is PHP 200 (PHP 100 for employees, PHP 100 for employers).

Weekly rest day – employees are entitled to 24 hours of uninterrupted rest after working six consecutive days.

Statutory holidays — like “regular holidays” wherein employees get a paid day off and might receive double pay if they work. Employees can usually take a substitute holiday on the first working day after the holiday if a statutory holiday falls on a weekend. Employees who work during a special holiday get a 30% pay increase

Night shift differential – the Labor Code mandates additional pay for night shift employees. This is called Night Shift Differential, which involves a 10% bonus for each hour worked between 10 PM and 6 AM.

Overtime – employees who work more than eight hours on a regular workday are eligible for 25% more pay at their average hourly rate.

Premium pay – employees receive additional payment for working on their days off. If they work on a rest day or special holiday, they get an extra 30% of their daily salary. If it’s both their rest day and a special holiday, they receive 50% extra. On a regular holiday that’s also their rest day, the employee gets an double pay and additional 30% of that double pay.

13-month pay – employers must provide 13th-month pay, an extra month of salary, to non-management employees. This payment must be made by 24 December, and some employees receive it in two installments. Employees are entitled to a pro-rated 13th-month pay.

Service incentive leave – employers must give at least five paid days off to employees working for a year. This can be used as sick or vacation leave.

Sick leave – employers are mandated by the Labor Code to provide at least 5 paid leave credits to regular employees when they want to rest, get medical consultations, or recover from being sick.

Maternity and Paternity leave – Whether married or unmarried, women are entitled to 60 days of paid maternity leave for their first four pregnancies, including miscarriages. If surgery is needed, such as a C-section or ectopic pregnancy, they are eligible for 78 days of paid leave.

Married men can have seven days of paternity leave for the first four pregnancies of their wives, but they can only apply for leave if they are living with their spouse at the time of delivery or miscarriage.

Solo parent leave – Single parents are allowed to take seven days of leave to fulfill their duties as a parent, where their physical presence is essential.