Hey HR friends 👋

Q3 is here, and it’s the perfect time to pause and run a quick mid-year payroll compliance check. Think of it as a health check for your payroll and statutory obligations in the Philippines. With deadlines coming up for SSS, PhilHealth, Pag-IBIG, and the BIR, being proactive now helps your business avoid stress and costly penalties later. And with Payruler, you can stay compliant without the hassle.

1. What are the updated contribution rates for 2025?

Staying on top of government-mandated contribution rates is critical for compliance. Here’s what employers and HR teams in the Philippines need to know:

- SSS. Starting January 2025, the total contribution rate increased to 15%, with the employer paying 10% and the employee covering 5%. The Monthly Salary Credit (MSC) range is now ₱5,000 to ₱35,000. This was confirmed by both the SSS along with their updated contribution table and noted in local coverage urging a postponement of the hike, not that it slowed anything down.

- PhilHealth. The contribution rate is now 5% of the monthly salary, and it's shared equally. The salary ceiling is ₱100,000.

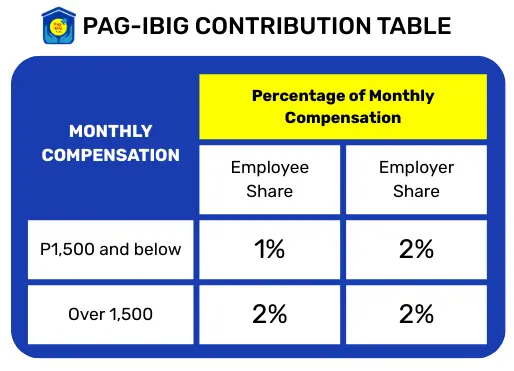

- Pag‑IBIG. Employees earning ₱1,500 or below pay 1%; those above pay 2%. Employers always match at 2%. Members may also opt to pay higher voluntary contributions to increase benefits.

Why this matters

Using outdated contribution tables can lead to incorrect deductions, frustrated employees, and penalties during audits.

2. What BIR deadlines should HR teams watch out for?

Tax compliance is another area that demands attention. According to the BIR tax calendar:

- Form 1601-C (Withholding Tax on Compensation) is due 10 days after month-end (e.g., July payroll withholdings were due on August 10).

- Quarterly forms like 2550Q (VAT) and 2551Q (Percentage Tax) usually fall around the 25th day after the quarter ends.

Pro tip: Double-check deadlines when they fall on national holidays (e.g., Ninoy Aquino Day, National Heroes Day). The BIR often adjusts due dates, but late filings still risk surcharges and penalties.

3. How should HR teams audit payroll and attendance?

A mid-year checkup is the best time to review your systems against DOLE standards:

- Are your semi-monthly payroll schedules (15th and last day of the month) consistent with Labor Code rules?

- Are overtime, night differentials, and holiday pay premiums computed accurately?

- Is attendance tracking reliable, especially in hybrid or remote setups where manual errors creep in?

Remember: Payroll accuracy is not just about compliance, it’s about maintaining employee trust.

4. How can Payruler make payroll and compliance easier?

Manual payroll and compliance audits can be stressful and time-consuming. Payruler, a Philippine HRIS with built-in payroll, ensures accuracy and peace of mind by providing:

- Auto-updated SSS, PhilHealth, and Pag-IBIG contribution rates (so you never miss an adjustment).

- Deadline reminders for monthly and quarterly government filings.

- DOLE-compliant payroll flows, handling semi-monthly pay cycles, holiday premiums, and prorations with ease.

- Audit-ready digital records—from payslips to remittance reports—all stored securely and accessible anytime.

Translation: Fewer manual errors, smoother operations, and more time for HR to focus on strategy and people.

5. What should be on your mid-year payroll compliance checklist?

Here’s a quick to-do list to help your HR and finance team stay ahead in 2025:

✅ Update contribution tables (SSS 15%, PhilHealth 5%, Pag-IBIG 1–2%).

✅ Review remittance schedules and BIR deadlines for July–December.

✅ Audit attendance systems for accuracy and completeness.

✅ Spot-check payroll runs for premiums, contributions, and withholding tax accuracy.

✅ Evaluate payroll tools—if they’re not cutting down manual work, it’s time for an upgrade.

In a NutshellA mid-year payroll compliance check in the Philippines isn’t just another HR routine—it’s a safeguard against penalties, audit risks, and employee dissatisfaction. By reviewing contribution rates, staying on top of BIR deadlines, and auditing your payroll systems now, you set your business up for a smooth year-end.

And with Payruler taking care of the heavy lifting, you don’t just stay compliant—you free up your HR team to focus on what really matters: your people and your company’s growth.

🚀 Ready to future-proof your payroll? Talk to us today - hello@payruler.com - and discover how automation makes compliance stress-free.