The new year has come. This means an opportune time to welcome changes. You might want to modify your desk setup, make more connections in the office, or get a tech upgrade. But one thing is for sure. The Social Security System (SSS) has updated the percentage of its member’s monthly contribution schedules. With the expected differences in the government-mandated benefit for employees, this might be a good year for HRs to switch to automation or polish their existing technology.

First things first: What is this SSS contribution change about? The new schedule of contributions follows the law signed by former President Rodrigo Duterte. The law is Republic Act 11199, also named the Social Security Act of 2018. Following the prescription of the said law, members’ contribution is increased to 14% from 13%.

Republic Act 11199 was in effect in January 2018 and was enacted in February 2019. The essence of the law is to “ensure the long-term viability of the Social Security System”. This extended capability of SSS is executed by the yearly increase of 1% in the SSS contribution from 2019 to 2025.

Key Details of the Social Security Act of 2018

Aside from the new 14% monthly member contribution starting this month, January 2023, the minimum and maximum monthly salary credits (MSC) are adjusted. MSCs are set to increase as well. To recap, MSCs serve as the bases of members’ contributions. The law alters the minimum MSC from P3,000 to P4,000 and the maximum MSC from P25,000 to P30,000.

Another highlight of the said law is the partition of the contribution between the employer and the employee. For privately employed members, their employer shoulders the increase in the contribution. Employers share 9.5%, while employees still pay 4.5%. With this arrangement, employees rejoice at the higher benefits from the same percentage. Meanwhile, self-employed, voluntary, non-working spouses, and OFW members are responsible for the increase in their contributions. contribution.

Here is a table to guide employers and employees about the latest updates in salary bracketing, SSS monthly contributions, and employee compensation (EC) amount. Moreover, the data shows the distribution of the employer and employee’s share of the total contribution.

To understand this better, here is an illustration of how the provisions of the law are applied. Let’s have Rose as a case in point:

Rose has a monthly pay of P23,000. SSS obliges her to pay a monthly contribution of P3,250. Her employer pays P2,215, while the remaining P1,035 is shouldered by Rose. For her part, the increase is not directly felt because the increase in her contribution is covered by her employer.

Payruler is up to date

There is a serious consequence when payroll computation is not updated in line with these changes the government mandates. Payroll masters and the HR team should update their tabs with the new SSS contribution schedules. Moreover, payroll computation is set to change yearly until 2025, as far as SSS deduction is concerned.

With payroll computation being an effortful task on its own, the yearly updates make it more demanding for HRs and payroll masters; thus, automating the alterations in the SSS schedules saves a significant amount of time. Furthermore, systematizing the change avoids any penalties that may be incurred by the employer for lacking up-to-date payroll schedules. With the enacted Republic Act 11199, adjusting payroll is one of the more intensive functions of payroll procedure, and it would be wise to do as much as possible with the least amount of flaws.

Payruler diligently updates the mechanics of its system so that users compute their team’s payroll according to the most recent government mandates. For 2023 and the years to come, HRs can sit back and feel secure that their payroll computation is abiding by the provisions of the law.

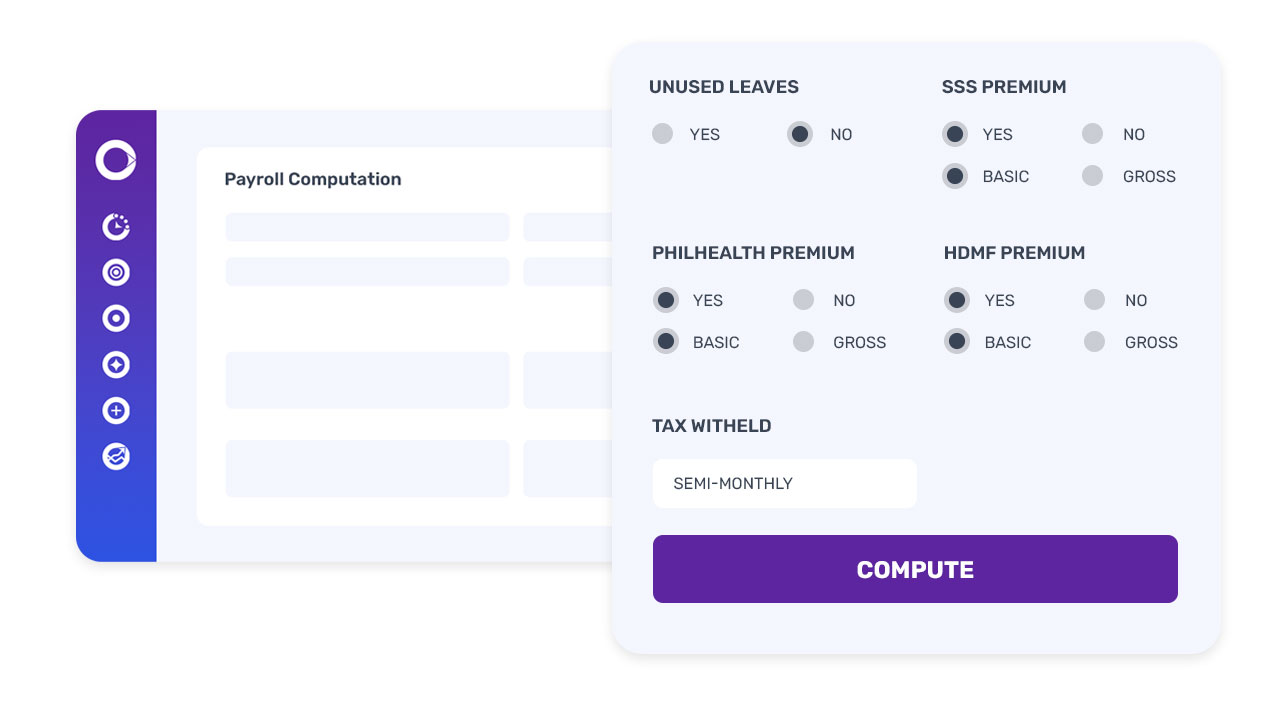

Not all payroll policies are created equal. In addition to aligning to the government-mandated contributions and benefits, the flexibility of Payruler gives payroll masters the capacity to compute payroll according to their unique policies.

The snapshot below is a sneak peek of how Payruler efficiently helps HRs in their payroll computation, along with the statutory government deductions. With the updates embedded in the system, payroll masters only have to select employees, tap payroll inclusions, and click ‘COMPUTE’. The SSS premium changes are reflected by conveniently clicking buttons to avoid manual computations.

With a few taps, HRs can readily generate accurate payroll in minutes. Hand tedious tasks Payruler, and let Payruler give you more significant time in your hands. Use the time for other things that matter: connect with a colleague, create team engagements, or brew a cup of coffee and take a break. After all, the essence of the updated SSS contribution is to value the people at work even more. It only pays to strengthen the linkages at work and take care of your well-being.