It’s that time of the year again where the holiday rush and cheer abound. Cue in the jingle bells, colorful Christmas lights, and the smell of puto bumbong in the cold breeze as you walk to the neighborhood church to attend simbang gabi. The best part? The year-end bonus or better known as the annual 13th month pay. This is the extra pay that gets deposited into your bank or handed to you in a nice envelope on or before December 24. It usually matches your monthly salary. And sometimes, this is given in instalments throughout the year, too. Indeed, ‘tis the season to be jolly and it’s high time to learn about this extra cash flowing in.

What is the 13th month pay?

Did you know that the 13th month pay was only legalized in the Philippines in 1975? That means, in the time of our grandparents, employers were not obliged to give any additional pay to employees at the end of the year. Today, almost everyone gets this additional pay by December. According to the Labor Code of the Philippines, all non-managerial employees who have worked with a company for no less than one month are qualified for the 13th month pay. And since it is a mandate under Presidential Decree No. 851, this differentiates the 13th month pay from the Christmas bonus.

Christmas bonus is an optional non-taxable benefit that is left at the discretion of the employers, whether they want to extend such benefit or not, which means this depends on the employer’s generosity, and possibly their holiday spirit.

Still, under the said Presidential Decree, there are still employers who are exempted to pay the 13th month benefit. They are the following: (a) government and any of its political subdivision, including government-owned and controlled corporations, except those corporations operating essentially as private subsidiaries of the government; (b) employers already paying their employees 13th month pay or more in a calendar year or its equivalent at the time of this issuance; (c) persons in the personal service of another in relation to such workers; and (d) employers who are paid on purely commission, boundary, or task basis, and those who are paid a fixed amount for performing a specific work, irrespective of the time consumed in the performance thereof, except where the workers are paid on piece-rate basis in which case the employer shall grant the required 13th month pay to such workers.

Who is entitled to the 13th month pay?

Whether still on probationary, already a regular employee or even an employee who is about to resign, every rank-and-file employee in the private sector receives the 13th month pay. As mandated by the latest guidelines from DOLE, as long as the employee has worked at least one month during the calendar year, the employee is eligible for this benefit.

How do you compute the 13th month pay?

According to the latest guidelines from DOLE, the minimum amount should not be less than one-twelfth of the total basic salary earned by an employee within the calendar year. To compute the 13th month pay, simply get the sum of the basic salary earned during the year divided by 12 months. Allowances and other benefits such as unused leaves converted to cash, night shift differential, and overtime pay are not included in the 13th month pay computation.

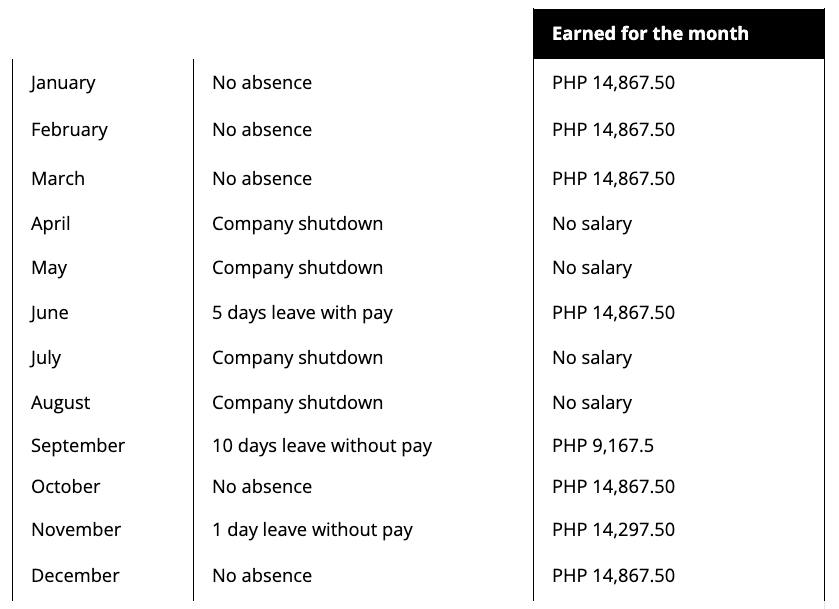

To illustrate:

Using the minimum wage in the National Capital Region at PHP 570 per day and a six-day workweek or an equivalent monthly basic salary of PHP 14,867.50

PHP 570.00*313 = PHP 178,410.00

PHP 178,410.00/12 months = PHP 14,867.50

In this example, PHP14,867.50 is the 13th month pay

This means, employees who have completed one month of the calendar year, whether probationary employees or employees who recently resigned or even for employees with work suspension, are entitled to a pro-rated 13th month benefit according to the number of months that the employee has rendered.

Here is an example from DOLE’s latest guidelines last October 25, 2021 on how 13th month pay is computed with work suspensions due to company closure are computed still using the same NCR minimum wage with six-day workweek on the previous example above:

Total basic salary earned for the year PHP 112,670

PHP 112,670/12 months = PHP 9,389.17 is the proportionate 13th month pay.

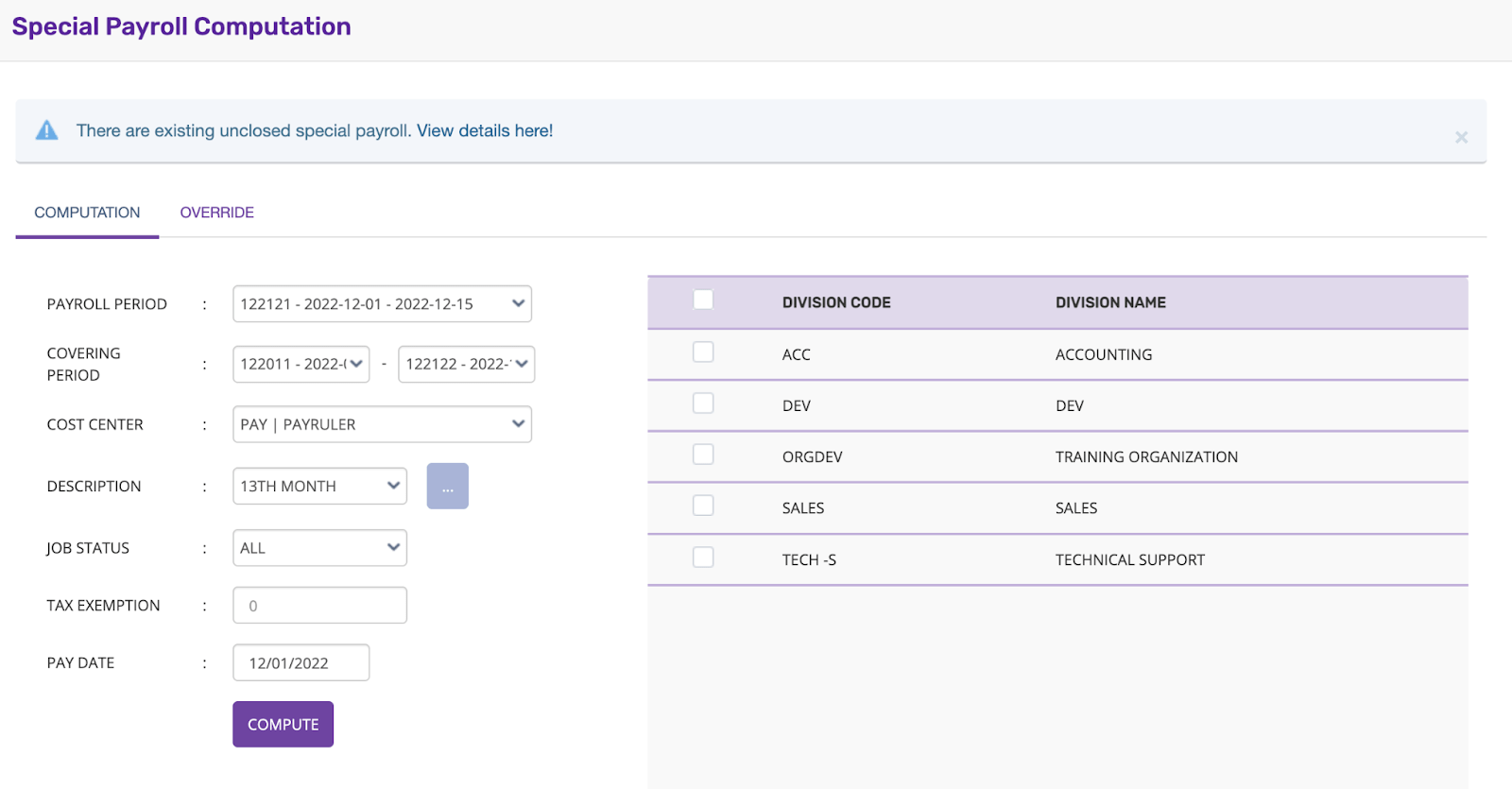

How Payruler automates the 13th month pay computation for you

Basic salary computation can get tedious in and of itself. Add 13th month pay to that and you are assured of a crazy holiday season rushing to meet deadlines and beating bank holidays. With Payruler’s module that’s designed to give a hassle-free and accurate computation of the 13th month pay and other bonuses, you can breeze through the yuletide madness of payroll sans the headaches. This is found in the Special Payroll module wherein everything is automated based on your existing payroll data, following the government mandated computation, and even customizable for unique allowances. This is done completely separate from the regular payroll computation so everything is clean and precise down to a tee.

Payruler’s Special Payroll module does all the nitty gritty for you. Now all you need to do is set it up with a few clicks on some dropdown boxes and click ‘COMPUTE’. And you’ll have an accurate 13th month pay computation that’s unique to your company, with taxes, allowances, and all, and even export a report even before you finish saying ‘Merry Christmas!’.

Enjoy the holidays this time around. Make it stress-free by letting go of manual time-consuming and time-crunching work. Let Payruler take care of it with just a few clicks! Allow yourself a break and make time for the more meaningful things and shift your focus on the very reason for the season. Talk to us today!