New year, newly reset holiday calendar.

Before getting too excited with the upcoming holidays, there’s something you must not let get drowned in the noise of festivities — no, it’s not practicing your department’s year-end dance production – it’s your holiday pay!

Understanding how holiday pay is calculated in the Philippines is crucial. It guarantees that employees are fairly compensated for working on a holiday. Thus, it guarantees legal observance for employers and averts employee salary disputes.

So let’s ask the most important questions:

- Do you, as an employer, abide by the Labor Code of the Philippines’ requirements regarding holiday pay?

- Are you properly compensated as an employee for your work on a holiday?

Read on to learn everything you need about holiday pay in the Philippines.

Holiday Types in the Philippines

Regular and special non-working holidays are the two types of holidays that exist in the Philippines.

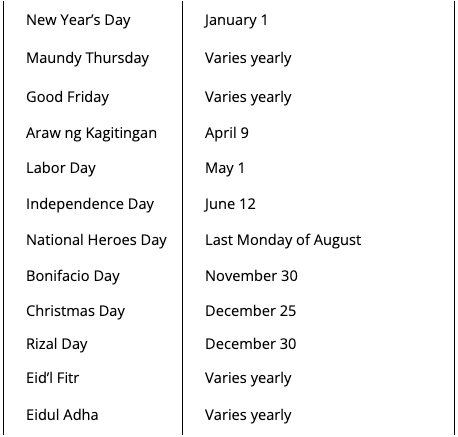

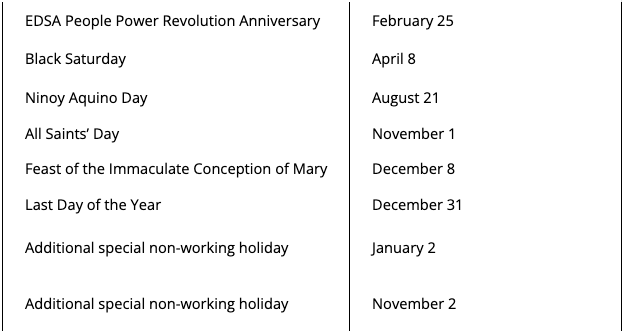

Regular holidays – Holidays that happen every year are set aside by law and have special cultural, social, or religious meanings. The Malacanang Palace recently released the list of Philippine Holidays for 2023 under Proclamation 90.

Special holidays, however, are decreed by the President or enacted by the congress.

Because some holidays in the Philippines are movable, providing a fixed list of dates for them is generally impossible. Before their occurrence, the President is required by law to issue a Proclamation under the terms of Republic Act 9492 to finalize the precise date of their observance.

Now that you’re aware of the holidays, you can have more time to plan your activities. However, you may wonder if the employees who report to work a full 8-hour shift are the only ones who paid during holidays? Read on to find out.

Holiday Pays Computation

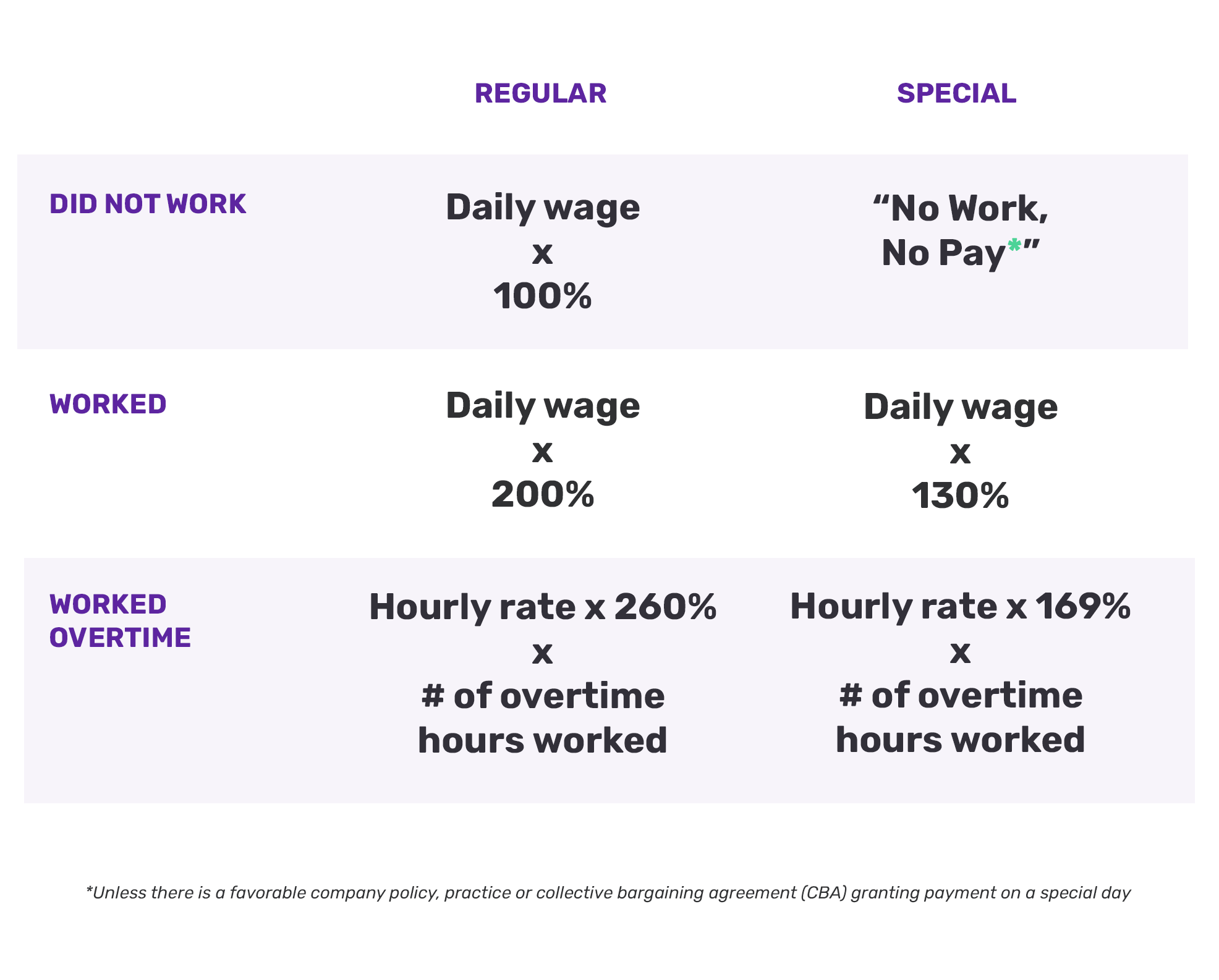

The Department of Labor and Employment (DOLE) has established the following rules for official holidays that employers must follow:

These are the legal guidelines and computation that your employer should follow when it comes to holiday pays. However, what happens if a holiday falls on your rest day? Continue reading below to find out!

What Happens If A Holiday Falls On Your Rest Day?

We’ve all been there. You’re looking forward to a long weekend, and then you realize that your planned rest day will fall on a holiday. Good thing DOLE has provided guidelines for your employers regarding the matter. See below:

- If an employee works on a special day that also falls on his/her rest day, he/she shall be paid an additional 50 percent of his/her basic wage on the first eight hours of work [(basic wage x 150%) + COLA].

- For overtime work on a special day that also falls on his/her rest day, he/she shall be paid an additional 30 percent of his/her hourly rate on the said day [Hourly rate of the basic wage x 150% x 130% x number of hours worked].

Final Thoughts

The long-awaited holidays are just around the corner! For employees, this means time spent catching up with family and friends, attending parties, and perhaps even taking a well-deserved break from work. But before you can enjoy your holiday break, there’s one important task that needs to be done: checking your payslip to ensure that you’re receiving the correct holiday pay.

The Philippine government has put in place several rules and regulations regarding holiday pay, all of which are designed to protect workers’ rights. If your payslip shows anything different from what you’re entitled to, don’t hesitate to report it to your employer.

With the correct information, they can make the necessary changes and ensure you receive the holiday pay you deserve. And once that’s all sorted out, you can finally relax and enjoy your well-earned break!